Halstead's latest venture, Varsity Express, launched operations between the UK cities of Oxford and Edinburgh on 1 March, using a Jetstream 31. It suspended flights on 8 March.

Halstead's latest venture, Varsity Express, launched operations between the UK cities of Oxford and Edinburgh on 1 March, using a Jetstream 31. It suspended flights on 8 March. Friday

Whoops, my airline's failed again!

Halstead's latest venture, Varsity Express, launched operations between the UK cities of Oxford and Edinburgh on 1 March, using a Jetstream 31. It suspended flights on 8 March.

Halstead's latest venture, Varsity Express, launched operations between the UK cities of Oxford and Edinburgh on 1 March, using a Jetstream 31. It suspended flights on 8 March. Tuesday

Metrojet eyes China and India in next phase of growth

Strong growth figures from Hong Kong-based business aviation charter and management provider Metrojet have prompted it to eye new prospects in China and India and an expansion of its maintenance unit at home The growth over the past year has come despite the economic downturn.

The company's fleet doubled to 20 business aircraft in the past 12 months with the addition of Bombardier Global Expresses and Gulfstream G550s and G200s. Four G200s are on Metrojet's aircraft operator's certificate and that tally should rise in 2010, says the operator, although it has a majority stake in only two G200s.

"Metrojet does not pursue aircraft ownership or lease opportunities since we view this as too capital intensive for our business model," says chief executive Chris Buchholz. "Our strategy is to focus on third-party aircraft management, which includes making our AOC available to those aircraft owners who want to defray the cost of aircraft ownership, as well as heavy maintenance of course."

Metrojet's maintenance unit, one of Asia's largest, will employ more than 100 people this year, it says. It has $30 million worth of Gulfstream spares, and has certifications to work on a wide range of aircraft. Aircraft on ground calls rose to more than "800 return-to-service events" last year for Asia-based and transient aircraft of various types, says Metrojet.

"This year, Metrojet will hire a significant number of maintenance professionals due to both the increase in the Hong Kong-based fleet and also regionally based aircraft that choose Metrojet to conduct heavy checks," says Buchholz. "There are plans for a third hangar at the Hong Kong Business Aviation Centre, and naturally Metrojet plans to have a significant presence there."

The company flew to more than 190 cities in at least 50 countries globally in 2009. India is an increasingly important long-term market, with many aircraft that are registered there using Metrojet's facilities for heavy checks.

"We feel it is important to bring Metrojet's business aviation excellence to China and India to ensure that new aircraft owners have a great aircraft ownership experience, to further stimulate market demand," adds Buchholz.

China is Metrojet's natural market, and the company is looking for a mainland partner to begin a flight operations business there. This partner has to share the company's "long-term commitment to safety and service excellence", says Buchholz.

"Finding the right partner is much more important than quickly going in," he adds. "In 2009, we have had a number of discussions with various parties, but no decision has been made. Our management and our shareholders are very keen and committed to entering the mainland China market for the long term."

Buchholz warns that while the Asian business aviation industry is recovering and foreign companies are increasingly keen to do business in the region, they have to be careful about who they go to bed with.

"The Chinese saying 'same bed but different dreams' comes to mind," he says. "While it's in the whole industry's interest to see the whole business aviation pie grow, foreign operators and MROs would be wise to be very selective in choosing a potential partner and in doing careful due diligence to ensure that all joint venture parties share similar values in terms of the relative priorities."

Metrojet is part of the Hong Kong Aviation Group (HKAG), which is owned by the Kadoorie Group. HKAG owns helicopter charter firm Heliservices, is the majority shareholder of the island's Business Aviation Centre, and has a substantial stake in commercial aircraft MRO firm Hong Kong Aircraft Engineering.

Monday

Embraer outlines timeframe for new product decision

Embraer expects to make a decision on product enhancements or a new commercial aircraft in 12-18 months.

Company EVP of the airline market Mauro Kern outlined that timeframe during the ISTAT annual conference today in Orlando, Florida, stating the time period to make a decision "could be shorter than that".

Kern says Embraer has several conceptual studies underway examining various scenarios including low- and high-speed turboprops, E-Jet family enhancements and larger aircraft featuring open rotor engine technology. He recently told ATI and Flightglobal that one product under consideration was a stretch of the E-195 internally dubbed the E-195X.

He emphasises that the 2014-2015 timeframe is not the right time to introduce a clean sheet aircraft design since it would heighten competition with Airbus and Boeing, companies that have a "fabulous customer base". Kern says new entrants attempting to compete with the two major airframers would face significant challenges.

With new technology such as the open rotor possibly maturing in the 2020-2025 timeframe, Kern believes aircraft developed using that and other available technologies could produce gains in cash operating costs.

In the short-term, Kern tells ATI and Flightglobal on the sidelines of the ISTAT conference that while Embraer is not engaged in active discussions with United Airlines, the airframer believes the E-190 could play a role in the major carrier's fleet.

United has reportedly invited Airbus, Boeing, Bombardier and Embraer to join discussions regarding a narrowbody order, which the carrier aims to place this year.

Embraer did not compete in the order that Republic Airways Holdings awarded to Bombardier last month for 40 firm 138-seat CS300 CSeries aircraft, says Kern, adding that was a competition to replace the Airbus narrowbodies operated by Republic's subsidiary Frontier Airlines.

Kern says the E-190 continues to play a key role in Republic's fleet. Republic in 2009 opted to purchase 10 E-190s from US Airways, and operates the aircraft from both Frontier's Denver hub and the Milwaukee base of Midwest Airlines. Republic closed on the acquisitions of both Frontier and Midwest in 2009.

Kern, meanwhile, admits there is a large amount of curiosity regarding Embraer's future plans for clean-sheet design or an E-Jet revamp.

"We want to make a mature decision," says Kern, who explains Embraer aims to add value to customers through its product offerings, rather than adopting a "me too" philosophy.

Cessna's Citation CJ4 has received US type certification around three and a half years after the light business jet was launched. The airframer is scheduled to deliver the first customer aircraft in the second quarter and around 15 CJ4s this year.

The $9 million Williams International FJ44-4A-powered, Rockwell Collins Pro Line 21-equipped CJ4 offers a maximum cruise speed of more than 450kt (840km/h) and a range of nearly 3,700km (2,000nm) with two crew and five passengers.

It also offers a direct climb to 45,000ft (13,720m) in 28min at maximum take-off weight. The CJ4 also introduces the Rockwell Collins Venue cabin management system that includes BluRay DVD with high-definition monitors, moving maps and XM radio.

The CJ4 is the newest and largest member of ubiquitous CJ family of business jets consisting of the Citation CJ1+, CJ2+ and CJ3. The CJ4 is approved for single-pilot operations and shares a common pilot type rating with the other CJs. Cessna has more than 150 orders to date for the CJ4.

Aircraft financiers predict the future

Aircraft financiers predict the future

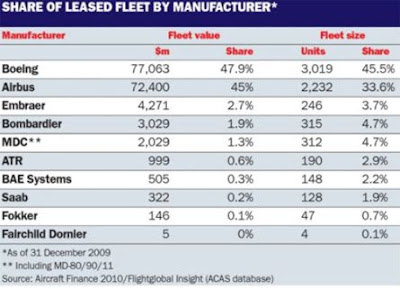

Perhaps the single most shocking civil aviation news of 2009 was that while the financial world - and the real economy, very much including the airline business - went into meltdown, Airbus andBoeing between them set an all-time record for airliner deliveries at 979 units.

While there was muchconcern last year about whether enough finance could be raised during a credit crisis to pay for all the aircraft coming off the assemblylines, the so-called "finance gap" was, ultimately, kept closed.

The spectre of a finance gap remains cause for some concern. And, lessors and airlines have begun to worry that fleet residual values could be hammered by the combination of a soft economy and the likelihood that Airbus and Boeing might imminently launch upgraded versions of their A320 and 737 narrowbodies.

FORECAST

So, for its Aircraft Finance 2010 special report, Flightglobal's Commercial Aviation Onlineasked appraisers for their views on the key events driving the market.

Avitas asset valuation vice- president Doug Kelly likes the first flight of the Boeing 787 as the topevent of 2009: "Despite all the delays and production problems, the 787 Dreamliner will no doubt be a huge success for Boeing and a game-changer for the industry."

But an alternative view comes from Collateral Verifications vice-president Gueric Dechavanne: "The most important event is more of a non-event:none of the major leasing companies, such as ILFC, CIT, RBS, etc were actually sold to outside investors.

"This says a lot about what investors think of the risk and potential volatility that can take place during downturns."

As for 2010, Kelly says the defining events will be "bankruptcies, mergers and the sale of ILFC".While many observers believe ILFC's parent, the troubled insurance giant AIG, to be holding off selling its leasing company until it can get a betterprice, Kelly says the sticking point might be potential buyers "waiting for the financial markets to improve so they can get a reasonable return on their money before consummating a deal".

He adds: "The Japan Airlines bankruptcy and its plans to phase out its Boeing 747-400s over three years will have a big impact on the market."

Kelly also expects Airbus and Boeing to repond positively to a push by Air France and Southwestfor a formal launch of A320 and 737 re-engining programmes.

Dechavanne anticipates "major aircraft orders fromseveral of the US carriers" and IBA senior analyst Alice Gondry expects values and lease rates to stabilise by the end of 2010, but warns that spring is crucial, as airlines discover"whether or not they have enough cash to ride out the storm".

She adds that first 787 deliveries should give the industry some momentum, while putting downward pressure on prices of older competitors such as 767.

However, Fintech Aviation Services managing director Oliver Stuart-Menteth is more cautious. He notes: "The major events in 2010 will be continued deferrals and increased cancellations of Boeing and Airbus orders as airlines realise that traffic is not going to recover as fast as corporate planning had forecasted, continued consolidation amongst flag carriers and continued renaissance of the turboprop in the 50- to 70-seat market."