Aircraft financiers predict the future

Perhaps the single most shocking civil aviation news of 2009 was that while the financial world - and the real economy, very much including the airline business - went into meltdown, Airbus andBoeing between them set an all-time record for airliner deliveries at 979 units.

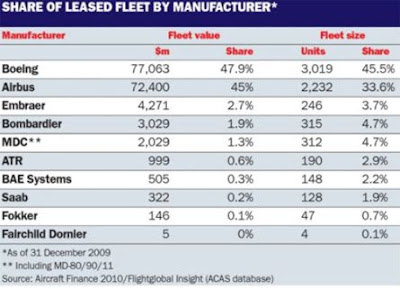

While there was muchconcern last year about whether enough finance could be raised during a credit crisis to pay for all the aircraft coming off the assemblylines, the so-called "finance gap" was, ultimately, kept closed.

The spectre of a finance gap remains cause for some concern. And, lessors and airlines have begun to worry that fleet residual values could be hammered by the combination of a soft economy and the likelihood that Airbus and Boeing might imminently launch upgraded versions of their A320 and 737 narrowbodies.

FORECAST

So, for its Aircraft Finance 2010 special report, Flightglobal's Commercial Aviation Onlineasked appraisers for their views on the key events driving the market.

Avitas asset valuation vice- president Doug Kelly likes the first flight of the Boeing 787 as the topevent of 2009: "Despite all the delays and production problems, the 787 Dreamliner will no doubt be a huge success for Boeing and a game-changer for the industry."

But an alternative view comes from Collateral Verifications vice-president Gueric Dechavanne: "The most important event is more of a non-event:none of the major leasing companies, such as ILFC, CIT, RBS, etc were actually sold to outside investors.

"This says a lot about what investors think of the risk and potential volatility that can take place during downturns."

As for 2010, Kelly says the defining events will be "bankruptcies, mergers and the sale of ILFC".While many observers believe ILFC's parent, the troubled insurance giant AIG, to be holding off selling its leasing company until it can get a betterprice, Kelly says the sticking point might be potential buyers "waiting for the financial markets to improve so they can get a reasonable return on their money before consummating a deal".

He adds: "The Japan Airlines bankruptcy and its plans to phase out its Boeing 747-400s over three years will have a big impact on the market."

Kelly also expects Airbus and Boeing to repond positively to a push by Air France and Southwestfor a formal launch of A320 and 737 re-engining programmes.

Dechavanne anticipates "major aircraft orders fromseveral of the US carriers" and IBA senior analyst Alice Gondry expects values and lease rates to stabilise by the end of 2010, but warns that spring is crucial, as airlines discover"whether or not they have enough cash to ride out the storm".

She adds that first 787 deliveries should give the industry some momentum, while putting downward pressure on prices of older competitors such as 767.

However, Fintech Aviation Services managing director Oliver Stuart-Menteth is more cautious. He notes: "The major events in 2010 will be continued deferrals and increased cancellations of Boeing and Airbus orders as airlines realise that traffic is not going to recover as fast as corporate planning had forecasted, continued consolidation amongst flag carriers and continued renaissance of the turboprop in the 50- to 70-seat market."

No comments:

Post a Comment